WTF is Chain Abstraction

Finance has always existed in siloes — both in traditional (bank-driven) spaces and in the blockchain/web3 world.

In the case of TradFi (traditional finance), however, centralized entities (banks and other financial institutions) took care of liquidity imbalances and management. The same cannot be carried forward into DeFi (decentralized finance) due to the lack of intermediaries. As a result, we now have a financial ecosystem that is fragmented even at the liquidity level.

Enter chain abstraction, a groundbreaking approach that could solve one of the most pressing issues in the crypto space — fragmented liquidity — while dramatically enhancing user experience.

The Problem: Fragmented Liquidity in a Multi-Chain World

To understand the significance of chain abstraction, we first need to grasp the current state of the blockchain ecosystem:

-

Multiple Layer 1 Blockchains: We have numerous Layer 1 blockchains like Ethereum each with its own native token and ecosystem.

-

Various Layer 2 Solutions: On top of these, we have Layer 2 scaling solutions like Optimism, Arbitrum, and Polygon, designed to improve the scalability of Layer 1 chains.

-

Isolated Liquidity Pools: Each of these chains and layers often has its own set of decentralized exchanges (DEXs) and liquidity pools.

The Result: A Fragmented Landscape

-

User experience inefficiencies

-

Liquidity fragmentation

-

Increased complexity for developers

User experience inefficiencies

Users often need to maintain different accounts or wallets across various chains to interact with their native decentralized applications (DApps).

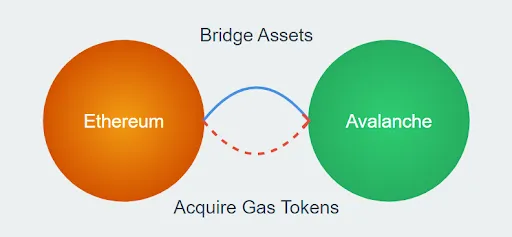

Example Scenario

Imagine discovering an emerging trend and token on the Avalanche chain while your assets are on the Ethereum chain. To capitalize on this opportunity, you would need to:

-

Bridge your assets from Ethereum to Avalanche

-

Acquire AVAX tokens to cover gas fees on the Avalanche network

This process is cumbersome and time-consuming, potentially causing users to miss out on opportunities or incur unnecessary costs. Above all,. It makes for a terrible user experience at the end of the day.

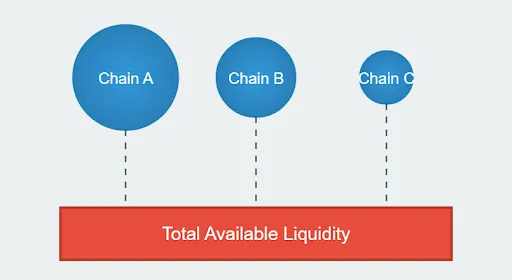

2. Liquidity Fragmentation

With liquidity spread across multiple chains and layers, individual pools often lack depth. This can lead to:

-

Higher slippage for large trades

-

Increased vulnerability to price manipulation

-

Inefficient capital utilization

3. Increased Complexity for Developers

DApp developers face significant challenges when trying to deploy their applications across multiple chains:

-

Need to adapt to different blockchain architectures

-

Managing multiple codebases and deployments

-

Ensuring interoperability between various versions of their dApp

These issues highlight the need for solutions that can abstract away the complexity of multiple chains, providing a seamless experience for both users and developers in the blockchain ecosystem.

The Solution: Chain Abstraction

Chain abstraction emerges as a promising solution to the challenges posed by liquidity fragmentation in the blockchain ecosystem.

By creating a unifying layer that operates above individual Layer 1 and Layer 2 solutions, chain abstraction aims to streamline the user experience and optimize liquidity utilization across the entire blockchain landscape.

Key Benefits of Chain Abstraction

-

Single Interface: Users interact with one interface to access liquidity and perform transactions across multiple chains.

-

Simplified Asset Management: No need to manually move assets between chains or understand the intricacies of different networks.

-

Reduced Cognitive Load: Users don’t need to know which chain offers the best liquidity or rates - the abstraction layer handles this optimization.

-

Gas Fee Abstraction: The complexity of different gas fee systems across chains can be hidden from the user, potentially even allowing for gas payment in any token.

-

Consistent Experience: Regardless of the underlying blockchain, users get a uniform, simplified experience.

Impact on the Blockchain Ecosystem

By implementing chain abstraction:

-

Universal Liquidity: Combined available assets across multiple blockchain networks through efficient cross-chain trades and exchanges. This enables users to seamlessly interact with new blockchain ecosystems, even without holding tokens on those specific chains.

-

Improved User Experience: Simplifies interactions with blockchain applications, potentially driving wider adoption of decentralized technologies.

-

Developer Efficiency: Allows developers to build applications that can easily tap into multiple blockchain networks without managing separate deployments.

How Chain Abstraction Works

Chain abstraction involves several key components working together to create a seamless, unified experience across multiple blockchains.

Here’s a technical breakdown of its core components and execution flow.

Cross-Chain Communication Protocol

-

Implements a standardized messaging format (e.g., Inter-Blockchain Communication (IBC) protocol).

-

Utilizes cryptographic proofs (e.g., Merkle proofs) to verify the state of transactions across different chains.

-

Employs relayers or validators to transmit and validate cross-chain messages.

-

Implements consensus mechanisms (e.g., Byzantine Fault Tolerance) to ensure agreement on cross-chain state.

Smart Contract Layer

-

Deploys specialized smart contracts on each supported blockchain.

-

Implements lock-and-mint or burn-and-mint mechanisms for cross-chain asset transfers.

-

Utilizes hash time-locked contracts (HTLCs) or similar constructs to ensure atomic swaps across chains.

-

Manages nonce and sequence numbers to prevent double-spending and ensure transaction ordering.

Unified Interface

-

Abstracts blockchain-specific details (e.g., gas fees, nonce management) behind a common API.

-

Implements a transaction routing layer to determine the optimal path for cross-chain transactions.

-

Provides SDK and libraries for developers to easily integrate chain abstraction into their dApps.

State Management and Synchronization

-

Maintains a global state that represents the aggregate state across all connected chains.

-

Implements efficient state synchronization mechanisms (e.g., zero-knowledge proofs, optimistic rollups).

-

Utilizes checkpointing and challenge periods to ensure state validity and allow for dispute resolution.

Liquidity Management

-

Implements automated market makers (AMMs) or other liquidity provision mechanisms across chains.

-

Employs liquidity balancing algorithms to optimize capital allocation across different chains.

Security Measures

-

Implements multi-signature schemes or threshold cryptography for enhanced security of cross-chain transactions.

-

Utilizes formal verification techniques to prove the correctness of critical smart contract logic.

-

Employs rate limiting and circuit breakers to prevent potential exploits or excessive capital flight.

Execution Flow:

-

A user initiates a cross-chain transaction through the unified interface.

-

The transaction is routed to the appropriate entry point on the source chain.

-

The source chain’s smart contract locks the assets and emits a cross-chain event.

-

Relayers pick up the event and transmit it to the destination chain, along with cryptographic proofs.

-

The destination chain’s smart contract verifies the proofs and executes the corresponding action (e.g., minting assets).

-

The unified interface updates to reflect the new state across chains.

This complex interplay of components allows chain abstraction to provide a seamless experience to users while maintaining the security and integrity of individual blockchain networks.

It’s worth noting that different implementations of chain abstraction may vary in their specific approaches, but these core principles generally apply across various solutions.

Conclusion

Chain abstraction represents the next big leap in blockchain technology. By solving the problem of fragmented liquidity and dramatically improving user experience, it has the potential to accelerate blockchain adoption and unlock the full potential of decentralized finance.

As this technology develops, we’re moving towards a future where the underlying complexities of blockchain are invisible to the end-user, much like how the average internet user doesn’t need to understand TCP/IP protocols to send an email.

The promise of chain abstraction is clear: a unified, liquid, and user-friendly blockchain ecosystem that’s accessible to all. As these solutions continue to evolve, we may be on the cusp of a new era in blockchain technology - one that finally bridges the gap between its immense potential and mainstream adoption.